1. Market Overview: Definition, Types, and Applications

Definition: PE stretch film (also known as stretch wrap) is a highly stretchable plastic film made primarily from polyethylene, used to unitize and secure products during storage or transit

. It is a form of secondary packaging that tightly wraps around items (often palletized goods) and clings to itself, stabilizing the load and protecting it from dust, moisture, and minor damage. Stretch films are valued for their flexibility, durability, and cost-effectiveness in packaging operations

. They help safeguard products against environmental factors, theft, and transit damage while keeping palletized loads intact

.

Types of Stretch Film: The two primary types are cast stretch film and blown stretch film, distinguished by their manufacturing process:

-

Cast Stretch Film: Made by a cast extrusion process where melted resin is extruded through a slit die and quickly cooled on chilled rollers

. This method is faster and yields cheaper film than blown extrusion. Cast films are clear, glossy, and quiet to unwind, making barcodes and labels easy to read

. They also have two-sided cling (helpful to hold layers together) but slightly less holding force and tear resistance compared to blown film

. Cast film dominates production – about 77% of stretch films are produced via cast extrusion as of 2023

, due to its high throughput and lower cost.

-

Blown Stretch Film: Manufactured by blown extrusion – resin is forced through a circular die then inflated into a bubble and cooled, forming film

. Blown film production is slower and costlier, but the film has higher toughness and cling. Blown stretch wrap is typically stronger with superior puncture resistance and load-holding force, making it ideal for heavier or irregular loads

. It is usually hazy in appearance and unwinds with a loud noise, with one-sided cling to avoid sticking to equipment

. Blown film accounts for roughly the remaining ~23% of stretch film output

and is often used in hand wraps where maximum toughness is needed

.

Main Applications: PE stretch films are ubiquitous in packaging logistics. Key applications include:

-

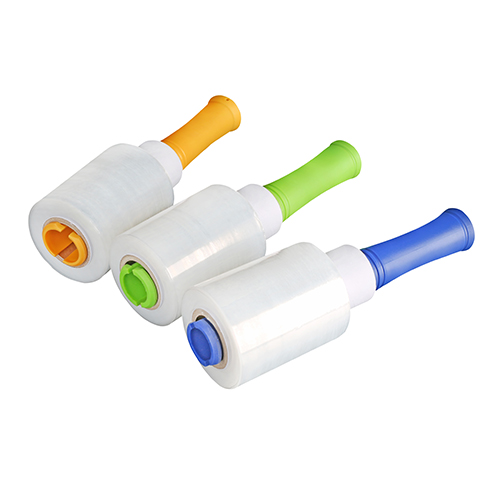

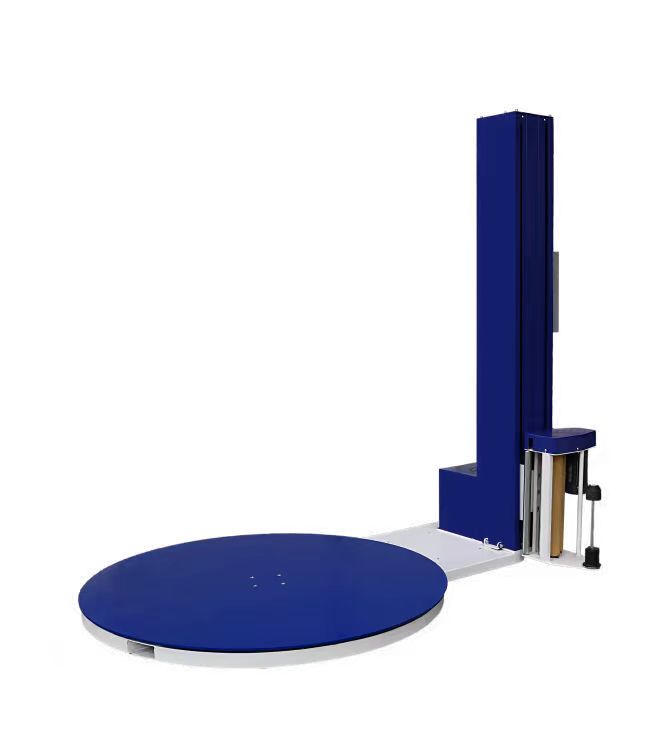

Pallet Wrapping: The most common use – wrapping loaded pallets in warehouses and distribution centers to stabilize goods for transport. Both machine-applied stretch wrap (on automated stretch wrapping machines) and hand-applied wrap are used. In 2023, machine wrap films comprised about 55–56% of stretch film usage, while hand wrap films made up ~40%

. Stretch hood films (tubular stretch films used as elastic pallet covers) account for a small portion (~2%) but are growing fastest for securing bulk materials like bricks or appliances

.

-

Bundling and Unitizing: Stretch film is used to bundle together smaller items (e.g. cartons, lumber, pipes) or odd-shaped products. Its elastic tension holds items tightly together. Industries like construction use stretch wrap to bundle building materials (pipes, timber, steel rods) for organized handling

.

-

Protection: The film provides a protective layer against dust, dirt, and humidity. For example, manufacturers wrap finished goods (appliances, furniture, etc.) to keep them clean. Stretch film can also deter tampering or pilferage (often the film must be cut or punctured to access the product, providing evidence of tampering).

-

Food & Beverage Packaging: While primary food packaging uses specialty films, stretch wrap is heavily used as a secondary packaging to secure stacks of packaged foods or beverage cases. Palletized food products, beverage multipacks, and bulk grocery goods are routinely wrapped for distribution

. (Shrink film is more common for directly bundling beverage cans or bottles, whereas stretch film is used around trays or pallets of such goods.)

Overall, stretch film’s versatility allows it to serve across industries – from consumer goods and e-commerce parcels to pharmaceuticals and industrial commodities – wherever secure, consolidated packaging is required for shipping and storage.

2. Current Market Size and Projected Growth (2025–2030)

The global polyethylene stretch film market has been experiencing steady growth and is projected to expand further through 2025–2030. In 2023, the stretch film market was valued around USD 4.8 billion

. By 2025, it is expected to reach the mid-$5 billion range, and forecasts indicate the market could grow to approximately USD 6.7–7.0 billion by 2030

. For instance, one industry analysis estimates the market will rise from $4.8 billion in 2023 to nearly $6.89 billion by 2030, representing a CAGR of about 5.3–5.5% during 2024–2030

. This growth rate outpaces many traditional packaging sectors, underscoring healthy demand drivers.

To put it in a broader context, when combined with shrink film (a related market), the overall stretch & shrink films sector was about $17.5 billion in 2023

. This combined market is projected to reach roughly $27–32 billion by the end of the decade, growing at ~6–7% annually

. Stretch films specifically constitute a significant portion of this total, owing to their wide usage in transport packaging.

Projected Growth Trends: Growth is expected across all regions (detailed in the next section) with particularly robust expansion in emerging markets. Key forecasts for 2025–2030 include:

-

Mid-Single-Digit CAGR: Most analysts project global stretch film revenues to grow around 5% per year over this period

. This sustained growth will be fueled by rising packaged goods production and heightened emphasis on safe, efficient logistics (e.g., more palletization as supply chains modernize).

-

Market Size by 2030: The global market is likely to add several billion dollars in value from 2025 to 2030. Estimates put the market in the high single-digit billions by 2030 (~$7B). Some variations exist: for example, a forecast by Fortune Business Insights projects $4.68 billion in 2025 to $6.71 billion by 2032 (5.3% CAGR)

, which aligns with the ~5% growth range. Overall, the trend is upward, with stretch film demand in 2030 roughly 1.5 times the demand in the mid-2010s

.

-

Volume Growth: In terms of volume, usage of PE resins for stretch film has also been climbing. One report noted stretch wrap consumed about 2.4 billion pounds of PE resin in 2019 (one of the fastest-growing segments for PE) and this has only increased

. By 2023, PE resin consumption for stretch films approached ~1.93 billion lbs (nearly 0.88 million metric tons) in key markets

. This indicates substantial material throughput that will grow with efficiency improvements (e.g., thinner films) moderating the volume increase relative to value increase.

-

2030 and Beyond: Looking slightly further out, forecasts to 2035 (by some market studies) show the stretch film market reaching ~$4.4–4.5 billion (if considering only stretch wrap films)

or higher if including all stretch-type films. The growth may temper slightly in mature markets, yielding a global CAGR of ~3–4% in the long term (2025–2035)

. Nonetheless, even the most conservative outlook expects continued expansion, with incremental market opportunities of over $1 billion in the coming decade

.

Table: Global Stretch Film Market Size and Growth

| Year | Market Value (USD) | Growth Trend |

|---|---|---|

| 2023 | ~$4.8 billion | Base year – post-pandemic demand surge in e-commerce and packaging. |

| 2025 | ~$5.3–5.5 billion (est.) | Continued growth; stretch films revenue in 2024 was ~$3.16B (excl. shrink)

. |

| 2030 | ~$6.8–7.0 billion | Projected ~5% CAGR (2024–2030), driven by emerging markets and new applications. |

<small>Note: Figures above are for stretch film market values. The combined stretch & shrink film market is larger (e.g., $17.7B in 2024 to $27.3B in 2030 at ~7.4% CAGR)

, indicating shrink films also contribute significantly to overall segment growth.</small>

3. Key Market Drivers and Restraints

The stretch film market’s growth is underpinned by several demand drivers, while it also faces noteworthy restraints and challenges. Understanding these factors is crucial to gauging future market dynamics:

Key Drivers

-

Boom in E-commerce & Logistics: The rise of e-commerce and complex global supply chains is a primary growth engine. As online retail and direct-to-consumer shipping expand, so does the need for secure palletization and packaging for transportation. Stretch films are critical for protecting goods during shipping – the surge in e-commerce has contributed to an estimated 30% increase in demand for stretch films in recent years

. In the U.S., for example, rapid e-commerce growth has markedly boosted stretch film usage to ensure secured product shipments and minimize transit damage

. This trend is global, as companies seek cost-effective ways to unitize loads in warehouses and delivery networks.

-

Rising Packaged Food & Beverage Demand: The food and beverage industry – including packaged foods, bottled drinks, and other FMCG products – is the largest end-user of stretch film, accounting for roughly 45% of total consumption

. Growth in population and disposable incomes (especially in Asia-Pacific and other developing regions) is fueling higher production of packaged foods and beverages

. This drives secondary packaging needs (palletizing cases of food, wrapping beverage pallets, etc.). Stretch films offer a convenient, hygienic way to secure bulk food products and extend shelf-life during distribution by keeping items intact and protected

. The increasing demand for frozen foods, beverages, and processed groceries in retail has a direct positive impact on stretch film usage

.

-

Industrial Growth & Infrastructure Development: Industrial and construction sectors also contribute strongly. As manufacturing output grows worldwide, more raw materials and finished goods require palletization. The construction sector in particular uses stretch film to wrap building materials (e.g., bricks, cement bags, lumber) for transport – this segment is expected to dominate certain markets with over 23% share of end-use

. Rapid industrialization in Asia and other regions means more goods (chemicals, textiles, consumer products, etc.) are being produced and shipped, bolstering stretch film demand as a cost-effective load securing solution.

-

Cost-Effectiveness and Efficiency: Stretch wrap remains one of the most economical packaging solutions for unitizing loads. It typically uses less material than other methods (like strapping or corrugated separators) and can be applied quickly

. The film’s high stretch yield means a little material can cover a large load. This cost advantage is a major driver for companies looking to optimize packaging costs. Additionally, compatibility with automated wrapping equipment provides labor and time savings in high-volume operations. As more warehouses and factories automate, stretch films benefit from being integral to those systems (supporting the “automation integration” trend)

.

-

Product Protection & Loss Reduction: The need to prevent product damage and reduce losses in transit is ever-increasing. Stretch film’s ability to hold items firmly reduces load shifting, breakage, and spillage. Industries facing high costs from damaged goods (electronics, appliances, glass products, etc.) are investing in better stretch wrap solutions (e.g., multi-layer films with greater holding force) to mitigate these losses. This reliability as a protective packaging boosts continued usage across sectors

. For instance, the use of stretch film in securing pharmaceutical and medical supplies grew during the pandemic era, as ensuring the safe delivery of these critical products became paramount.

-

Technological Advancements in Film: Continuous innovation – discussed in detail in Section 6 – is also a demand driver. New high-performance films (e.g., thinner nano-layered films that maintain strength) are encouraging adoption as they allow users to downgauge (use less plastic per load) without sacrificing performance. This appeals to cost and sustainability objectives, thereby attracting more customers and applications for stretch film. As one report notes, manufacturers are rolling out films that are stronger and lighter, with enhanced puncture resistance and even anti-static properties for sensitive goods

. Such improvements expand the range of goods that can be safely wrapped and increase overall consumption (because stretch wrap becomes viable for more challenging loads that might have used other methods).

Key Restraints and Challenges

-

Raw Material Price Volatility: Stretch film is made from petroleum-based polymers (primarily LLDPE/LDPE). Fluctuations in crude oil and petrochemical feedstock prices directly impact resin costs, leading to cost volatility for stretch film producers and buyers. In recent years, manufacturers have faced periodic spikes in polyethylene prices, which squeeze margins and can make stretch film more expensive for end-users

. For example, supply disruptions (like the 2021 Texas freeze or global logistics bottlenecks) led to resin shortages and higher prices, posing challenges. High raw material costs are consistently cited as a restraining factor that can dampen market growth or push users to thinner films and alternative packaging

. Manufacturers must manage this risk via resin purchasing strategies or by incorporating recycled material when possible to buffer cost swings.

-

Environmental and Regulatory Pressures: Being a single-use plastic product, stretch film faces increasing scrutiny over its environmental impact. Plastic waste concerns and government regulations are significant headwinds. Many regions (especially Europe) have enacted or are planning stringent rules on single-use plastics, recycling mandates, or taxes on plastic packaging that lacks recycled content. Such regulations can raise compliance costs or limit the use of traditional stretch films. For instance, environmental concerns have caused about a 25% slowdown in traditional polyethylene film adoption in some areas, as companies preemptively seek greener alternatives

. Europe’s push for a circular economy and laws requiring packaging recyclability or recycled content (like the UK’s Plastic Packaging Tax, which effectively mandates 30% recycled content) force stretch film producers to reformulate or risk losing business. Bans on plastic waste imports and pollution directives (in China, EU, etc.) also drive up the need for recycling infrastructure – a challenge for stretch film which often isn’t collected from end-users. Collectively, these sustainability pressures restrain unchecked growth and require the industry to adapt (see Section 7 on sustainability).

-

Low Recycling Rates & Disposal Issues: Stretch film, after use, is generally disposed of, contributing to plastic waste streams. Recycling stretch wrap is possible (it’s typically made of recyclable PE), but in practice recycling rates are low – only about 21% of stretch films are recycled in the U.S. and ~30% in Europe

. The reasons include contamination (stretch wrap often is soiled from transit), collection challenges (used primarily in industrial settings, requiring separate collection programs), and economics (it can be cheaper to produce new film than to collect and process used film). This low recycling rate means a vast majority of used film ends up in landfills or incineration, which is a sustainability concern and a restraint on growth (as corporations try to reduce their waste footprint). The waste issue also opens the market to criticism and risk of replacement by re-usable solutions (discussed below).

-

Potential Substitutes and Reusable Solutions: While stretch film is a dominant method for securing loads, there are emerging alternatives aiming to reduce plastic use. Reusable pallet wrapping systems (like pallet sleeves, bands, or reusable textile “wraps”) are being explored by some companies to cut down on single-use plastic. Studies estimate that up to 20% of stretch wrap applications could be replaced by reusable systems in certain industries

– for example, closed-loop warehouse circuits where the same pallets move back and forth can potentially use durable covers instead of new wrap each time. Additionally, adhesive-based unitizing (a sprayed tackifier between layers of boxes) and strapping machines can in some cases reduce the amount of stretch film needed. While these alternatives are not yet mainstream, they pose a long-term risk to stretch film demand, especially as sustainability goals strengthen. If even a fraction of businesses switch to reusables, it could temper stretch film market growth.

-

Market Maturity in Developed Regions: In highly developed markets (North America, Western Europe), the use of stretch film is already widespread and optimized. These markets are mature, so growth is slower and largely tied to GDP or manufacturing output increases. For example, Europe and North America have high per-capita usage of stretch wrap; thus, incremental growth is moderate. A research report noted the food and beverage sector in these regions is mature in its use of stretch/shrink films, potentially limiting growth prospects compared to emerging markets

. This maturity means suppliers must rely on product innovation or competitor displacement to grow in these areas, rather than organic demand surges. It also leads to intense price competition among many players, which can restrain revenue growth even if volume grows.

-

Highly Fragmented Competition: The stretch film industry is quite fragmented with many regional and local producers (see Section 5). This competitive landscape can act as a restraint on pricing power and profitability. Buyers have many options, which can drive prices down. Additionally, smaller competitors may undercut with lower-cost offerings (especially in regions with lower production costs or recycled material usage), making it challenging for big players to expand margins. Fragmentation means the market doesn’t always move in unison – for instance, overcapacity in one region can lead to price drops that affect the global market. While not a direct restraint on demand, competition dynamics do influence market health and the pace of growth in value terms.

In summary, the market’s expansion is fueled by strong demand from logistics and consumer goods sectors, but it must navigate cost volatility and the growing mandate for sustainability. Companies that innovate to address environmental issues (through recycling, biodegradable films, etc.) stand to turn some of these challenges into opportunities.

4. Regional Market Breakdowns

Geographically, the PE stretch film market has distinct regional characteristics in terms of size, growth rate, and end-use focus. Below is an overview of key regions during the 2025–2030 forecast period:

North America: This region (primarily the U.S. and Canada) represents one of the largest markets for stretch film, with an estimated 30–35% of global market share by value

. North America’s prominence is driven by its large-scale retail and industrial sectors and advanced logistics infrastructure. The U.S. alone accounts for ~30% of global stretch/shrink film demand

, thanks to booming e-commerce, extensive food processing industries, and a high degree of palletized shipping in retail (big-box stores, etc.). Demand is significant in the food & beverage industry and consumer packaged goods sector, with major companies (PepsiCo, Nestlé, Coca-Cola, etc.) consuming vast amounts of stretch wrap to secure products

. North America also has a trend of automation in warehousing, driving use of machine-grade stretch films and innovative wraps that improve efficiency

. Growth in NA is steady but moderate – expected CAGR around 2–4% through 2030. While the market is mature, sustainability initiatives are strong; many companies are switching to films with recycled content and more efficient wrapping techniques. Overall, North America will continue to generate substantial revenue, although its global share may slightly decline as emerging regions grow faster.

Europe: Europe is another major market, holding roughly 20–30% of the global stretch film market (depending on inclusion of shrink films)

. Western Europe in particular (Germany, France, U.K, Italy) has high usage in food, beverage, and consumer goods packaging. Europe’s growth is relatively slow (~1–3% CAGR) due to market saturation and strict environmental regulations

. The EU’s focus on sustainability is a defining feature: stretch film suppliers in Europe are investing in recyclable and downgauged films to comply with regulations (e.g., waste directives, recyclability requirements)

. This sometimes increases film costs but also spurs innovation (e.g., bio-based PE stretch films and high recycled-content films are gaining traction in Europe). European industries continue to use stretch wrap heavily for secure transport, but some sectors are near maturity, and any volume growth may come from Eastern Europe’s industrial expansion or replacement of shrink wrapping with stretch hood in certain applications. Regionally, Germany is a key market (strong food processing and export industries demand a lot of pallet wrap)

, and Spain, U.K, Italy also contribute significantly. By 2030, Europe’s share of the global market might plateau or slightly decrease as Asia-Pacific surges, but it will remain a lucrative market focused on high-quality, sustainable films. European stretch film demand is also influenced by the prevalence of organized retail and export-oriented manufacturing, which keep usage high

.

Asia-Pacific: The Asia-Pacific (APAC) region is the largest and fastest-growing market for PE stretch films in volume terms. As of 2023, APAC accounted for about ~45% of global stretch and shrink film revenue – the single largest regional share

. This dominance is fueled by rapid industrialization, urbanization, and population growth in countries like China, India, and Southeast Asian nations. China is a major consumer, with huge end-use industries (electronics, textiles, consumer goods, chemicals, and especially food & beverage) that drive stretch film demand

. The rise of manufacturing and exports in China means massive numbers of pallets get wrapped for both domestic distribution and export shipping. Similarly, India and Southeast Asia are seeing increased use of stretch film as retail infrastructure develops and supply chains modernize (e.g., more organized retail, more cold chain logistics for food). APAC’s growth outlook (2025–2030) is robust: forecast CAGRs in developing Asian markets range from 5% up to 6%+

. For instance, India is projected to grow around 6.3% and China around 5.6% annually through the mid-2030s

. This outpaces growth in North America or Europe by a wide margin. Key drivers in APAC include the strong food & beverage processing industry (to feed growing populations)

, expansion of manufacturing (more goods needing packaging), and increasing adoption of modern packaging solutions in ASEAN countries. Additionally, the e-commerce boom is very pronounced in Asia (e.g., the rise of giants like Alibaba, Flipkart, etc.), leading to more logistics and warehouse use of stretch films. By 2030, APAC will likely solidify its position, potentially exceeding 50% of global volume consumption. Many global packaging companies are focusing investments in APAC, seeing it as the region of new opportunities and capacity expansion

. The only caveat is that in value terms, APAC’s share might be slightly lower than volume share (because price points in emerging markets can be lower), but as of mid-2020s, sources still show APAC leading in revenue (~44.9% share) due to sheer scale

. Environmental regulations in APAC are also tightening (e.g., South Asia promoting biodegradable films for sustainability)

, so the market is turning towards greener stretch films over time.

Latin America: Latin America is a smaller portion of the global stretch film market (part of the “emerging markets” category contributing ~10% or less of share combined with MEA)

. However, it shows steady growth potential. Major contributors in LATAM include Brazil, Mexico, and Argentina, where food & beverage, agriculture, and industrial goods sectors are driving packaging demand. For example, Brazil’s large personal care and beverage industries are boosting usage of secondary packaging films

. Latin America’s stretch film market is expected to grow in tandem with its economies – likely a moderate CAGR (3–5%) through 2030, as modernization of retail and manufacturing continues. The region has also seen increased agricultural exports (fruits, meats) which require palletizing and wrapping for shipment. Companies in LATAM are investing in local production of films to reduce imports

. As a result, by 2030 Latin America will have a slightly larger market than today, but its global share may remain modest. Key trend: in many LATAM countries, cost-effective packaging is critical, so demand leans toward economical films; however, awareness of sustainability is rising in more advanced economies like Chile and Brazil, slowly influencing a shift to recyclable materials.

Middle East & Africa (MEA): The Middle East & Africa region currently represents the smallest share of the stretch film market (part of the ~10% “rest of world” along with LATAM)

. But MEA has a unique set of drivers. In the Middle East (GCC countries), booming logistics hubs (e.g., UAE, Saudi Arabia) and petrochemical exports create demand for pallet wrapping to protect goods in transit. Moreover, many Middle Eastern economies are diversifying into food manufacturing and pharmaceuticals, increasing local packaging needs. Africa is at an earlier stage of market development; however, growth in consumer goods consumption and retail in nations like South Africa, Nigeria, and Egypt is gradually boosting stretch film use. The MEA region is witnessing an uptick in international trade, and with it, a greater emphasis on proper packaging for transport

. For example, South Africa’s food manufacturing sector (notably large in bakery and consumer foods) uses stretch film extensively to distribute products, and major beverage companies (like Coca-Cola) drive demand for shrink/stretch films in Africa

. From 2025 to 2030, MEA is expected to see moderate growth (~4% CAGR) – higher than Europe, albeit from a smaller base. The expansion of organized retail and foreign investment in manufacturing in Africa will slowly increase stretch film adoption. Additionally, some Middle Eastern film producers (often integrated with polymer production) are expanding capacity, improving availability and reducing costs in the region. By 2030, MEA will still be a relatively small but growing market segment, with a focus on cost-effective and efficient packaging solutions as economies develop

.

Regional Outlook Summary: Overall, the developing regions (Asia-Pacific, and to a lesser extent Latin America and parts of MEA) are expected to outpace the growth of developed regions (NA, Europe). Asia-Pacific, already large, will be the main engine of volume growth in stretch films, thanks to industrial expansion and urbanization. North America and Europe will focus on value-added growth – adopting newer, sustainable products and automation – but with modest volume increments. This dynamic means the global market’s center of gravity is shifting slightly toward Asia. Nonetheless, North America and Europe will remain key in terms of technological leadership and high-quality product demand, while APAC will lead in sheer scale.

For quick reference, the table below shows an approximate regional breakdown and trends:

Table: Regional Market Share and Growth Highlights (Mid-2020s)

| Region | Approx. Share of Global Market | Growth Trend (2025–2030) | Notable Features & Drivers |

|---|---|---|---|

| Asia-Pacific | ~45% (largest) | Highest growth (4–6% CAGR) | Rapid industrialization, strong F&B sector, e-commerce boom; China & India lead volume. |

| North America | ~30% | Moderate growth (2–4% CAGR) | Mature market with high automation; sustainability push (recycled content films) is strong. |

| Europe | ~20% (Western & Eastern) | Slow growth (1–3% CAGR) | Highly regulated (focus on recyclability); demand plateau in F&B, but innovation in green films. |

| L. America | ~5%–7% | Steady growth (3–5% CAGR) | Growing food processing and consumer goods sectors; adopting modern packaging gradually. |

| Middle East & Africa | ~5% or less | Moderate growth (~4% CAGR) | Expanding trade and local manufacturing; cost-effective packaging needed, nascent sustainability efforts. |

Sources: Global market analyses

; CAGR estimates from regional forecasts (FMI, TMR)

.

5. Competitive Landscape: Major Manufacturers, Market Share, and M&A

The global stretch film industry is competitive and fragmented, featuring a mix of large multinational corporations and numerous regional players. No single company dominates the market, and even the top manufacturers collectively account for only a minority share of total volume, which has led to competition largely based on price, quality, and innovation.

Market Fragmentation: According to industry analysis, the top 3 manufacturers hold only about 18% of the global stretch film market (by revenue)

, and the top 10 players combined hold roughly 30%–31%

. This means ~70% of the market is served by a long tail of smaller and mid-sized companies. In fact, beyond the top tier, there are dozens of medium players and a large number of local producers (Tier 3) that cater to regional demand

. This fragmentation is partly due to the relative ease of setting up film extrusion operations and the wide geographic distribution of demand (which allows local firms to thrive by saving on freight costs for bulky film rolls). It also stems from historical development – different regions have their own leading suppliers.

Major Global Manufacturers: Despite the fragmented nature, several key companies stand out as market leaders in stretch film production:

-

Berry Global Group, Inc.: Berry (based in the USA) is one of the world’s largest plastic packaging companies and a leading producer of stretch films. Berry significantly expanded its stretch film portfolio with the acquisition of AEP Industries in 2017, a deal worth $765 million that added about $1.1 billion in annual flexible film sales to Berry

. With that, Berry became a powerhouse in North America’s stretch film market – Berry’s stretch films (often sold under brands like Clarus, Stratos, etc.) serve both machine and hand wrap segments. The company has multiple manufacturing sites in the U.S. and abroad. Berry continues to invest in the sector; for example, it announced a $30 million expansion of its stretch film plant in Lewisburg, Tennessee to add 20 million pounds of capacity for high-performance films, responding to rising demand

. Berry also emphasizes sustainability, recently launching a stretch film with 30% post-consumer recycled (PCR) content (the “Bontite Sustane” film)

.

-

Sigma Plastics Group: A large privately-held film manufacturer in the U.S., Sigma Plastics is a major player in stretch film (among other polyethylene film products). Sigma operates numerous extrusion plants across North America. It’s known for high-volume production of stretch wrap for both industrial and agricultural use. Sigma’s decentralized structure and multiple brands make it less visible publicly, but it is frequently listed among the top global producers

. Sigma, alongside Berry, essentially leads the North American market.

-

Scientex Berhad: Based in Malaysia, Scientex is a prominent stretch film manufacturer in the Asia-Pacific region (and globally by volume). Scientex has a strong export business, supplying stretch films to over 60 countries. To extend its reach, Scientex has been investing overseas – it opened a new stretch film plant in the United States (South Carolina) in 2021

, a $43 million investment aimed at servicing the U.S. market. Scientex’s strategy exemplifies the globalization of the stretch film industry, bridging Asian manufacturing expertise with Western market demand.

-

Thong Guan Industries (TG Group): Headquartered in Malaysia, Thong Guan (often referred to as TG) is another leading Asian producer known for its high-quality, multi-layer stretch films. The company has pioneered nano-layer stretch film technology (producing films with dozens of layers for enhanced performance). Thong Guan has grown its global presence and is considered among the top stretch film exporters, serving Asia, Europe, and North America. It was highlighted as a key global player alongside Berry and Sigma

.

-

Trioworld Group: A European leader (based in Sweden, formerly known as Trioplast), Trioworld is a major stretch film supplier in Europe and has been actively expanding through acquisitions. Trioworld produces a range of stretch films (including manual, machine, and specialty films) and also other plastic films. In 2022, Trioworld acquired two UK stretch film companies (Eurofilms and Quality Films), consolidating them into Trioworld UK

. In March 2023, Trioworld further expanded by acquiring Malpack, a Canadian stretch film producer, marking its entry into the North American market

. These moves, along with investments in new extrusion lines (Trioworld NA added a new 67-layer nano-line in 2023 for advanced films), indicate Trioworld’s aggressive strategy to grow its global footprint. With ~€850 million turnover in plastic films

, Trioworld is one of the largest players in Europe, particularly strong in industrial and agriculture stretch films.

-

Intertape Polymer Group (IPG): Intertape (headquartered in Canada, with major operations in the US) is a significant manufacturer of packaging products, including stretch film (machine and hand grades). IPG has multiple facilities producing stretch film (including some acquired operations). In 2022, IPG itself was acquired by an investment firm (Clearlake Capital) and taken private, but it remains a key competitor, especially in the Americas. IPG’s stretch films are sold under names like StretchFlex and they target both distribution and end-user markets.

-

Paragon Films: A U.S.-based company specializing in stretch wrap, Paragon is known for its high-performance machine films. It was cited as one of the notable players globally

. Paragon has a strong presence in North America for applications in food, consumer products, and logistics.

-

Amcor plc: Amcor is a global packaging giant (headquartered in Switzerland/Australia) that produces a wide array of packaging. While much of Amcor’s business is in consumer packaging and shrink films, it does have stretch film products (especially after acquisitions like Bemis). Amcor often appears in lists of stretch/shrink film companies

, likely due to its shrink film for beverage multipacks and some stretch hood offerings. Its presence indicates how large packaging firms cover both shrink and stretch as complementary solutions.

-

Bolloré and Coveris: In Europe, Bolloré (France) is well-known for high-quality shrink and some stretch films, particularly in specialized uses (e.g., pre-stretched hand films). Coveris (a packaging company in Europe) also produces stretch hood and lamination films and was mentioned among prominent companies

. These companies, along with regional players like Manuli Stretch (Italy), Ergis Group (Poland), Armando Alvarez (Spain), Polifilm (Germany), etc., form the competitive fabric in the EMEA region.

-

Others: The market features many other players: Mima Film (a brand historically linked with Signode’s stretch film equipment, known for machine films), Integrated Packaging (Australia, now part of Pro-Pac), M.J. Maillis (Greece, focuses on strapping but also stretch film), Efekt Plus (Poland), Malpack (Canada, now Trioworld), Megaplast (Greece, known for perforated stretch film for ventilation), Valgroup (Brazil, large flexible packaging firm with stretch film capacity), and numerous Chinese producers serving local markets (e.g., Guangzhou Xing, Shandong Fullway, etc.).

This wide array of competitors keeps the market very price-competitive. It’s notable that the top 10 companies only account for ~31% of the market, and the next 20 players add another ~28%, leaving ~41% to countless smaller firms

. This underscores how dispersed production is globally.

Market Share & Leadership: Berry Global is often considered the largest single producer of stretch film worldwide (especially after absorbing AEP) – for context, AEP alone had $1.1B in sales in flexible packaging

and Berry’s Engineered Materials division (which includes stretch films) is a multi-billion segment. Scientex and Sigma are contenders for high-volume output as well. No public exact market share breakdown is available due to private companies, but collectively, Berry, Sigma, and Thong Guan (TG) are estimated as the top 3 by volume, with combined share <20%

.

Competitive Strategies: Companies are differentiating themselves via:

-

Technology & Quality: e.g., offering multi-layer nano films, higher stretch performance, or tailored films (anti-UV, anti-static, etc.).

-

Sustainability: integrating recycled content and bio-based materials to appeal to eco-conscious customers.

-

Geographic Expansion: setting up or acquiring plants in new regions to be closer to customers (reducing shipping costs and import tariffs). The recent acquisitions by Trioworld and expansions by Scientex in the US illustrate this.

-

Vertical Integration: Some players, like those in the Middle East (e.g., petrochemical companies that also make films), leverage raw material integration to be cost-competitive. Others partner closely with resin suppliers (e.g., using special metallocene LLDPE from ExxonMobil or Dow to create premium films).

Mergers & Acquisitions: The industry has seen ongoing consolidation in the last decade, although from a fragmented base. Notable M&A activities include:

-

Berry Global & AEP Industries (2017): As noted, this merger created a North American stretch film giant and has been one of the largest deals in this sector

. Berry has also acquired other film businesses (like Clopay’s plastics division, though that was more trash bags and personal care films) and continuously optimizes its portfolio.

-

Trioworld’s acquisitions: In 2021–2023, Trioworld acquired Eurofilms, Quality Films (UK) and Malpack (Canada), significantly expanding its market share in Europe and entering North America

. Earlier, Trioworld had also acquired a French stretch film company (CGP Plastiques in 2019) and a Dutch one (Apeldoorn Flexible Packaging’s industrial film division) – reflecting a strategy to consolidate European market share.

-

Intertape Polymer Group: IPG acquired Cantech (tapes) and Polyair (protective packaging) in late 2010s, and also had earlier purchased a stretch film manufacturing facility in South Carolina. IPG’s growth in stretch film has been partly through these acquisitions to broaden its product line for distributors.

-

Amcor & Bemis (2019): Amcor’s acquisition of Bemis created a behemoth in flexible packaging. Bemis had some stretch film for food packaging and medical uses, which Amcor absorbed. This wasn’t a stretch-film specific merger, but it impacted the competitive landscape in flexible films broadly.

-

Others: Ergis (Poland) merged with other local film businesses; Jindal Films (mostly BOPP films, but an example of consolidation in adjacent films). The trend is that larger players are seeking to buy up smaller competitors to gain capacity, technology, or market access, leading to a gradual increase in concentration. Transparency Market Research observed “an increasing shift toward market consolidation” in the stretch/shrink films space as of the late 2010s

. We can expect further M&A as the market leaders aim to increase their global presence and smaller, less efficient producers potentially exit or get acquired.

Competitive Outlook: Competition is likely to intensify around innovation and sustainability. With margin pressure due to many competitors, companies are focusing on R&D to offer higher value products and on cost reduction (through scale or integration). Strategic partnerships are also seen – for example, resin suppliers like Dow or ExxonMobil often collaborate with film producers to develop next-gen films (ExxonMobil worked with film extruders to introduce new performance polyethylene grades for stretch films

). The entrance of private equity (as with IPG’s purchase) suggests outsiders see value in consolidating and growing these businesses.

In conclusion, the competitive landscape is characterized by a few big global firms (Berry, Sigma, Scientex/TG, Trioworld, IPG) and a long list of smaller regional specialists. Market share is distributed, but a slow consolidation is underway via acquisitions and expansion of the top players. Companies that can scale up, adopt new technologies, and meet sustainability requirements are poised to gain share during the 2025–2030 period.

6. Technological Developments and Innovations

Technology in the stretch film industry has advanced considerably, turning what might seem like a commodity product into a high-tech material in some cases. Innovations span materials, processes, and application equipment, all aimed at improving performance or efficiency. Key technological developments include:

-

Multi-layer & Nano-layer Films: One of the most significant advancements is the move from monolayer or few-layer films to multi-layer coextruded films, including so-called nano-layer technology. Modern cast extrusion lines can produce stretch film with dozens of micro-layers (e.g., 27, 55, or even 67 layers) by alternating different polymer formulations

. These nano-layer films capitalize on layering to greatly enhance toughness, tear resistance, and stretchability while using less material. For example, a 55-layer nano-film can be made thinner (down-gauged) without losing strength, because the layered structure prevents propagation of tears and distributes stress better

. Film thicknesses of 10–12 microns that perform like a traditional 20 micron film are now possible

. Several top manufacturers (e.g., Thong Guan, Trioworld, Berry) have invested in such nano-layer extrusion lines. In 2023, Trioworld North America installed a new 67-layer cast film line, highlighting the push towards extreme multi-layer tech for “super” stretch wraps that are ultra-thin yet high-performance

. The benefit is two-fold: end-users get more pallet wraps per roll (reducing cost and weight), and the overall plastic usage is reduced (sustainability gain) without sacrificing load integrity.

-

Higher Performance Resin Formulations: Parallel to layering, innovations in polymer chemistry have boosted film capabilities. Metallocene-catalyzed LLDPE (mLLDPE) grades and special octene-based LLDPEs provide greater puncture resistance and elasticity. The typical stretch film today is a blend of LLDPEs (butene, hexene, octene types) with some LDPE or other additives

– this blend is continually optimized. Recently, resin suppliers introduced grades that allow thinner films, better cling, or specific properties (e.g., ExxonMobil’s Exceed XP line of performance PE or Dow’s ELITE AT resins). One example is the development of anti-static stretch film: In 2023, ExxonMobil launched a stretch film designed to dissipate static, targeting packaging of sensitive electronics

. This innovation prevents dust attraction and electrostatic discharges which can damage electronics – a niche but growing need. Also, UV-resistant films for outdoor storage (containing UV inhibitors) and temperature-resistant films (for cold storage that remain elastic at low temps) have been developed.

-

Pre-Stretched Films: A different approach in technology is pre-stretched film, where the film is stretched close to its yield point during manufacturing. This yields rolls that look “waffled” and can be very light yet strong. When applied, they don’t require as much stretching by the user. Pre-stretched hand films have gained popularity for manual wrapping, as they reduce worker effort and film waste (since the film cannot be over-stretched to breaking – it’s already optimized). Companies like Bolloré and Trioworld have offerings in this space. The equipment to pre-stretch at high speeds during production is an innovation that has improved over the years, making these products more consistent.

-

Automation and Machinery Integration: On the equipment side, stretch wrapping machines have become more sophisticated, and film technology is adapting in tandem. Automatic stretch wrappers now commonly have power pre-stretch carriages (stretching the film 200-300% before applying to the load). Films are being engineered to handle very high pre-stretch levels (250% and above) without snapping. This means a given length of film covers more pallet rotations, improving efficiency. Film formulations and thickness profiles (down-gauging the edges vs center, etc.) are tweaked to work optimally with machines. Furthermore, as industries integrate Industry 4.0 and IoT, there is talk of “smart” packaging – for instance, incorporating RFID tags or indicators in stretch film for track-and-trace or tamper evidence. While not mainstream yet, some concepts involve stretch film that can sense load tension or environmental conditions (though these are experimental). Nonetheless, the idea of “smart stretch wrap” aligning with automated warehouses is on the innovation horizon

.

-

Biodegradable and Bio-based Films: Technologists are also exploring new materials to address environmental concerns. One avenue has been bio-based PE – chemically identical polyethylene made from renewable resources (like ethanol from sugarcane, e.g., Braskem’s “I’m Green” PE). Some stretch film producers now offer film made with a percentage of bio-based content to reduce fossil footprint (though the performance is the same as normal PE). Another area is biodegradable stretch films. Traditional PE is not biodegradable, but researchers have experimented with blending in biodegradable components or using compostable polymers. However, achieving the necessary stretch and strength with fully biodegradable polymers (like PLA or PHA) is challenging. A compromise has been oxo-biodegradable additives that make PE fragment over time; these are controversial in terms of environmental benefit. Nonetheless, a few stretch film brands market oxo-degradable versions for customers who demand a faster break-down of film in the environment. The uptake is still limited, and regulatory trends in Europe discourage additives that create microplastics. So the focus is more on recyclable and recycled content than on making stretch film truly biodegradable.

-

Recycled Content Integration: Not exactly a performance “innovation” but a technical challenge that’s being overcome: using post-consumer recycled (PCR) polyethylene in stretch film. Historically, stretch wrap needed very high-quality resin to achieve uniform stretching and strength, which made using recycled material (often of lower quality) difficult. Recent advances allow 20–30% PCR content to be used without severely impacting film properties

. For example, Paragon Films and Berry Global have developed stretch films with 30% PCR that still meet performance specs

. The technology here involves better filtration of recycled resin, blending strategies, and multi-layer structures (e.g., sandwiching PCR in inner layers). This is more of a sustainability-driven innovation, but it requires technical fine-tuning.

-

Ventilated Stretch Films: In terms of product innovation, another development is ventilated stretch film (films with perforations). These allow air flow to the wrapped goods – useful for perishable produce, cooling of hot-filled products, or preventing condensation. Companies like Megaplast (Greece) innovated this category with films that have holes or die-cut patterns. This technology ensures the film still has tensile strength while providing ventilation. It’s a smaller segment but important for agriculture (e.g., wrapping palletized fruits or vegetables that need to breathe, or palletized beverages that are warm and need to cool).

-

Enhanced Cling and Surface Properties: There have also been improvements in the cling formulations (the stickiness that makes the film layers adhere). Modern stretch films often are one-sided cling (especially blown films – cling on the inside to stick to the layer below, but a non-cling outside so pallets don’t stick to each other). Advanced cling additives ensure consistent tackiness without transferring to products. Anti-static additives as mentioned are also an enhancement for surface property. Some films are designed with low noise unwind (especially cast films for hand use in quiet environments), achieved by specific resin choices and two-sided cling that reduces friction noise.

-

Data Monitoring & Software: High-end users are even employing load containment measuring devices (some developed by stretch film companies or equipment makers) that can test how tightly a load is wrapped (containment force). This is more an application innovation: the ability to quantify containment force and optimize it. Combined with software that tracks film usage by machine, companies can optimize wrap patterns. Although this is more on the user side, it is driving film makers to provide products that are consistent and can be dialed in precisely via machine settings.

In essence, while the core concept of stretch film (stretchy plastic that wraps pallets) remains the same, the technology behind it has evolved to produce stronger, thinner, and smarter films. These innovations are crucial as they enable the industry to meet demands for cost reduction and sustainability. For example, downgauging through nanolayer tech has allowed some users to reduce film usage by 30-50% by weight per pallet, a significant material saving without losing load stability

. Likewise, the push for recycled content films is making stretch wrap more circular.

We can expect further innovations by 2030, such as even higher layer counts (100+ layers), integration of machine learning in wrapping equipment (to adjust tension dynamically), and perhaps breakthroughs in material science enabling a fully recyclable stretch film economy (closed-loop systems). Some companies are already trialing closed-loop recycling programs where used stretch film from warehouses is collected and recycled back into new film, supported by new sorting and processing tech

. These technological strides will shape the market by enabling stretch films to remain indispensable while aligning with future requirements.

7. Environmental Factors and Sustainability Trends

Sustainability has become a central theme in the stretch film market, as the industry faces pressure to reduce its environmental footprint. Environmental considerations are influencing product development, usage patterns, and regulations. Key trends and factors include:

-

Recycling Initiatives: Improving the recyclability and actual recycling rates of stretch film is a major focus. Stretch film is made of polyethylene, which in theory is fully recyclable. However, as noted, actual recycling rates are low (~21% in the US, 30% in Europe)

due to collection and contamination challenges. To tackle this, initiatives such as store drop-off programs (for consumers to return used stretch wrap, like from large appliance packaging) and closed-loop recycling in industries are being implemented. For example, Coca-Cola’s supply chain has piloted a closed-loop system to collect stretch wrap from its distribution centers and recycle it into new film

. Some packaging distributors offer balers to warehouses to compact used stretch film for recycling. The aim is to increase recycling rates significantly by 2030.

-

Recycled Content Usage: As part of a circular approach, stretch film manufacturers are introducing products with recycled content. A notable trend is the use of 30% PCR content in stretch films, which aligns with regulatory incentives (e.g., the UK’s tax threshold) and corporate sustainability pledges. Berry Global’s new stretch film with 30% PCR is one such example

, and other companies like Valgroup and Trioworld have similar offerings

. By incorporating PCR, the demand on virgin resin is reduced and a market for recycled plastic is created. The challenge is balancing recycled content with performance – too much PCR can weaken film or make it less clear. But advances (multi-layer structures where PCR is in core layers) have made 20-30% PCR feasible without major performance loss

. Going forward, targets of 50% or more recycled content may be pursued if quality can be maintained.

-

Downgauging (Source Reduction): A straightforward way to be sustainable is using less material for the same job. The industry has made continuous progress in downgauging stretch films – i.e., reducing thickness/weight per pallet wrapped. Whereas a typical machine film in the 1990s might have been 20+ microns thick, today 12–15 micron films can secure a load due to stronger resins and multi-layer tech. Using less plastic per wrap means less environmental impact. Many end-users now monitor how many grams of film they use per pallet and try to minimize it. Light-weighting is encouraged as long as it does not compromise load safety. This trend not only cuts costs but also reduces waste generation at the source. We can expect the average gauge of films used to continue to drop over 2025–2030 as technology allows.

-

Biodegradable and Compostable Options: There is interest in films that break down more readily after use, to avoid long-term pollution. A few products on the market are advertised as biodegradable stretch film, often via additives that cause the film to oxo-degrade over a few years. However, the environmental community has mixed views on these (they may create microplastics). Fully compostable stretch films (e.g., based on PLA) are not yet commercially viable for heavy-duty use – they lack the needed stretch and strength. Research is ongoing into polymers or blends that could be compostable. Some startups have looked at PU-based elastic films or PHA blends as alternatives. If breakthroughs occur, we could see niche use of compostable stretch wrap for certain applications (perhaps light bundling in food industry) by 2030. Currently, the mainstream approach is recycling rather than biodegradability for stretch films.

-

Regulatory Compliance: Environmental regulations are both a challenge and a driver for sustainability improvements. Europe leads here: the EU’s Circular Economy Package and directives on packaging waste push for all packaging to be recyclable or reusable by 2030. Many European countries also have Extended Producer Responsibility (EPR) schemes requiring producers to finance recycling of packaging. These regulations force stretch film producers and users to ensure films are recyclable (which PE film is) and to actually recycle a portion. Some countries or states are even discussing bans on certain single-use plastics, though stretch film (as an industrial necessity) is less likely to be banned outright. Instead, mandates like Italy’s law favoring compostable plastics or various plastics taxes influence the market. For instance, the UK Plastic Packaging Tax (2022) charges £200/ton on plastic packaging with <30% recycled content, which has spurred companies to use recycled stretch film to avoid the tax. We’ll see more such regulations globally, including potentially in the US (some states are exploring similar taxes or requirements). Compliance will require reporting recycled content, ensuring recyclability (no PVC or problematic additives), and possibly designing films for easier recycling (e.g., avoid excessive cling additives or multi-material blends that complicate recycling).

-

Corporate Sustainability Goals: Many end-user companies (the ones using stretch film) have public sustainability commitments to reduce plastic use or increase recycled content in packaging. For example, multinational firms might pledge to make all packaging recyclable and include certain recycled content by 2025 or 2030. Stretch film falls under these pledges. As a result, large buyers are pressuring stretch film suppliers to provide greener options. This has a ripple effect across the market, essentially making sustainability a competitive factor. Companies that can provide a credible solution (e.g., a stretch wrap that is both recycled and high-performing) can gain preferred supplier status. Additionally, some corporations aim to reduce plastic waste by X% – one way is optimizing pallet wrap usage or using reusables where possible. Such internal initiatives in big logistics operations (Amazon, Walmart, etc.) directly impact stretch film demand and usage patterns.

-

Reusable Packaging Systems: From a sustainability perspective, completely eliminating single-use wrap in certain closed loops is a tantalizing goal. As mentioned earlier, about 20% of stretch wrap could potentially be replaced by reusable systems in the long run

. Some companies are testing reusable pallet bands, stretch netting, or durable rubber/plastic sheets to wrap pallets, especially for internal transfers. If these systems prove effective and cost-efficient, they could reduce the volume of stretch film consumed. On the other hand, the stretch film industry is responding by emphasizing that new thinner films and recycling can achieve sustainability without losing the flexibility that stretch film offers. Reusable solutions are not one-size-fits-all (they require reverse logistics and are prone to loss or damage), so their adoption might be limited. But they do represent a sustainability trend to watch.

-

Lifecycle Analysis and Carbon Footprint: Customers are increasingly asking for the carbon footprint of packaging. Stretch film producers are now calculating the CO₂ emissions per kg of film and working to reduce it – through using renewable energy in factories, using bio-based/recycled content, and light-weighting. Some films carry environmental product declarations (EPDs) to help end-users quantify impacts. Also, incorporating renewable energy (e.g., solar at production sites) or improving transport efficiency (shipping more rolls per truck due to thinner films) are part of sustainability strategies.

-

Waste Reduction and Education: A softer aspect of sustainability is educating users on proper wrap techniques to avoid waste (e.g., not over-wrapping, avoiding film damage), and promoting recycling at end-of-use. Industry groups and companies are providing training and resources so that the film that is used is used optimally and then recovered.

In summary, sustainability is reshaping the stretch film market. We see a strong trend toward “greener” stretch films: thinner, recycled, and part of a circular lifecycle. Environmental factors are no longer peripheral; they are becoming central to product design and business strategy. By 2025–2030, we can expect stretch film products to routinely feature recycled content, and recycling streams for stretch film to be more established globally. Manufacturers that proactively embrace these trends (investing in recycling capacity, R&D for sustainable materials, etc.) will likely fare better in an era of eco-conscious packaging. As one report encapsulates, technological advancements in biodegradable and recycle-friendly films are opening new opportunities in the market, aligning with rising environmental concerns

. The push for sustainability is thus both a challenge and a key opportunity for innovation in the stretch film industry.

8. Raw Material Trends and Supply Chain Dynamics

Raw Materials: The primary raw material for PE stretch film is polyethylene resin, especially Linear Low-Density Polyethylene (LLDPE). LLDPE (often co-polymerized with alpha-olefins like butene, hexene, or octene) provides the high stretch and tensile strength needed. It is usually blended with a percentage of Low-Density PE (LDPE) to enhance clarity and tear propagation resistance

. Modern stretch films typically consist of 75–95% LLDPE and 5–25% LDPE (plus minor additives)

. Sometimes a bit of polypropylene (PP) or other polymers are blended for specific properties, but PE is by far dominant (PE comprises ~70% of the material segment in stretch films by usage)

. The types of LLDPE used include conventional Ziegler-Natta LLDPEs and metallocene LLDPEs (mLLDPE), each contributing different attributes (metallocenes give better elasticity and puncture resistance, but are costlier).

Supply Sources: LLDPE and LDPE are commodity polymers produced from ethylene, which is derived from natural gas or crude oil. The supply chain for these resins is global – with major production hubs in North America (especially the U.S. Gulf Coast), the Middle East (Saudi Arabia, UAE, etc.), and Asia (China, South Korea, Southeast Asia). The late 2010s saw significant capacity expansion in North America for LLDPE due to the shale gas boom (cheap ethane feedstock) and in the Middle East due to abundant petrochemicals, leading to a generally well-supplied market. However, disruptions can occur (e.g., plant outages, geopolitical events).

Price Trends: Polyethylene prices are cyclical and tied to petrochemical markets. For instance, PE prices climbed sharply in 2021 amid pandemic recovery and supply hiccups, then moderated. These fluctuations directly impact stretch film prices, since raw resin can account for a major portion of cost. When resin prices spike, stretch film producers often implement surcharges or price increases; conversely, in oversupply situations, film prices can drop as resin gets cheaper. The volatility of raw material costs is a key challenge noted by the industry

. Many stretch film buyers have seen their costs vary year to year because of resin swings. To mitigate this, some large users engage in resin futures contracts or buy resin directly and toll-produce film.

Supply Chain & Logistics: Stretch film is a bulk, relatively low-value-density product, meaning shipping it long distances can be cost-inefficient. This has influenced the geographic dispersion of film production – producers tend to set up plants near major markets to reduce freight costs (you’re essentially shipping a lot of air when shipping lightweight film rolls). As a result, while resin might be globally traded, film conversion tends to be more local/regional. There is a trade flow though: for example, Middle Eastern or North American resin might be exported to Asia, turned into film there, and that film may even be exported regionally. But more often, resin is exported and film made close to where it will be used.

During 2020–2022, global supply chain issues (port congestion, container shortages) also affected the packaging industry. However, since stretch film production is widespread, the market did not face severe shortages of film itself – the bigger issue was resin availability during events like the Texas freeze of 2021. That event took a significant chunk of US polyethylene capacity offline temporarily, causing global resin shortages, which in turn made it hard for film producers to get raw material. Lead times for film lengthened and some smaller converters had to halt production for lack of resin. The lesson learned has been the importance of supply chain resilience: many film makers now keep larger resin inventories or diversify suppliers to avoid disruption.

Resin Technology Trends: On the raw material side, resin producers continue to innovate as well – offering grades specifically for stretch films that allow higher stretch percentages, better puncture resistance, and easier processing. For instance, newer LLDPE grades can enable >300% stretch on machine lines without neck-in or breakage. The use of “super hexene” or “octene” LLDPE (with higher alpha-olefin content) can improve film strength

. Also, mLLDPE has become more common in stretch film; it’s often used in the skin layers of a film to impart toughness and clarity. mLLDPE is more expensive, so its usage is balanced with cost – typically a few layers in a multi-layer film contain metallocene resin for performance, while core layers use conventional butene LLDPE for bulk.

Regional Resin Dynamics: An interesting trend is shifting resin production cost advantages – e.g., North America’s shale advantage made it a low-cost PE producer, turning the U.S. into a net exporter of LLDPE. This led to relatively stable or lower resin prices in the late 2010s, boosting margins for film producers in NA. Conversely, Asia often had to import resin or use naphtha-based production which can be higher cost, affecting film prices there. However, China and India have invested in new PE plants to become more self-sufficient. By 2025–2030, we may see China becoming a net exporter of PE as well, given the massive capacity additions, which could keep global resin prices in check (benefiting film producers).

Feedstock and Sustainability: Another raw material trend is the emergence of bio-based ethylene (from ethanol) for making bio-LLDPE, as mentioned earlier. While still a small fraction of the market, some “green polyethylene” is finding its way into stretch films for brands that want a renewable content story. Also, chemical recycling of plastics could in the future provide feedstock for new PE resin (so-called recycled resin that is virgin-equivalent). If chemical recycling scales up, theoretically stretch film waste could be converted back into new PE monomer. This is still at pilot stages but by 2030 it might contribute some raw material, helping close the loop.

Additive Supply: Beyond base polymer, stretch film recipes use additives like tackifiers (for cling), antioxidants, UV stabilizers, etc. Supply chain for these additives (often specialty chemicals) also matters. A shortage in a particular additive can constrain a certain film formulation. However, these are used in small quantities. One particular additive of note is polyisobutene (PIB), commonly used as a cling agent. There have been instances of tight supply for PIB. Manufacturers have alternative cling tech (like Mettallocene-based cling or EVA copolymers) to mitigate this.

Logistics and Distribution: Most large stretch film makers supply both direct to large end-users and through distributors. Distributors (packaging wholesalers) play a big role, especially in North America and Europe, in stocking and supplying stretch film to small/medium businesses. The supply chain here is mature. One dynamic is that high resin prices can squeeze distributor margins unless they pass increases to customers quickly – sometimes there’s a lag which affects stocking strategy. In recent times, the quick swings in resin costs made some distributors reduce inventory to avoid holding high-cost product if prices fall. In 2023–2024, as supply chains normalized, many in the distribution chain operated on just-in-time purchases. By 2025–2030, the trend might stabilize with moderate inventory levels, but any new shock (like a geopolitical event hitting petrochemicals) could again disrupt availability.

Global Trade and Tariffs: Trade policies can affect raw material flow and costs. For example, China imposed tariffs on US PE during trade disputes, which impacted resin trade patterns. Also, anti-dumping duties on certain countries’ stretch film (there have been cases where countries levy duties to protect local film producers from underpriced imports) can alter competitive dynamics. Generally, stretch film isn’t as heavily traded as resin (due to freight inefficiency), but within regions like EU or NAFTA, cross-border trade is common. Companies have to navigate these aspects in their supply chain strategy.

In summary, the raw material and supply chain landscape for stretch films is characterized by close linkage to the polyethylene industry. Ample global resin capacity and diversified production locations are positives, but price volatility and occasional disruptions are the key challenges. Most stretch film producers have adapted by becoming more flexible in formulations (to use different resin types if needed) and by focusing on waste reduction (recycling scrap, etc.). Resin price remains the single biggest cost factor, so the market watches ethylene/LLDPE trends closely. If forecasts of resin overcapacity hold, stretch film makers may enjoy moderate resin prices in the late 2020s, aiding profitability (unless oil prices surge unexpectedly). Conversely, any supply crunch in raw materials could temporarily slow the market’s growth or shift competitive advantage to those who secured supply. Overall, a stable raw material supply with incremental improvements (like better, greener resins) is expected as the base for the stretch film market’s development through 2030.

9. End-User Industry Trends

The demand for stretch film is ultimately driven by its end-use industries. Understanding how these industries are evolving helps clarify the consumption patterns of stretch film. Key end-user segments and their trends include:

-

Logistics & Warehousing (E-commerce and Retail Distribution): This is arguably the backbone of stretch film usage – nearly every product that moves through a supply chain can involve a stretch-wrapped pallet. The explosive growth of e-commerce has been a game-changer. Companies like Amazon, third-party logistics (3PL) providers, and traditional retailers ramping up online sales have massively increased throughput in warehouses, each pallet or package often stabilized by stretch wrap. The trend in this sector is towards faster operations and automation. High-speed automatic pallet wrappers and even robotic stretch wrappers (where the wrapper moves to the pallet) are being adopted to keep up with throughput. This drives demand for consistent, high-quality machine-grade films. Another trend is more frequent, smaller shipments (the “last mile” distribution, where goods move in smaller batches but more frequently); while stretch film is used less on individual parcels, it’s crucial at distribution centers that consolidate packages. Seasonal peaks (like holiday seasons or big online shopping days) cause spikes in stretch film consumption. Additionally, direct-to-consumer meal kits, grocery delivery, and other services mean more packaging per unit of goods – often items are gathered on pallets for localized delivery, again wrapped securely. With e-commerce expected to continue growing globally, the logistics sector will remain a strong pillar of stretch film demand through 2030. An insight from FMI noted that in the US, e-commerce growth has made stretch films “critical for maintaining product integrity and safe delivery”, as supply chains get more complex

.

-

Food & Beverage Industry: As mentioned earlier, food and beverage is the largest consumer of stretch (and shrink) films. Here we consider everything from processed foods, beverages, frozen foods, to wholesale groceries. Trends in this sector affecting stretch film include: growth in packaged food consumption worldwide (especially in developing markets where more people are buying packaged and processed foods), and the expansion of cold chain logistics for perishable foods (which uses a lot of stretch film to unitize products in refrigerated trucks/warehouses). The beverage industry also continues to use stretch film heavily – though shrink wrap is used for bundling packs, those packs are then palletized and stretch-wrapped. A specific trend is the proliferation of bottled water and soft drinks in emerging markets, requiring tremendous quantities of secondary packaging. However, one counter-trend is that in some cases, shrink film and stretch film can substitute for each other – e.g., some beverage companies might switch from stretch-wrapping pallets to using stretch hooders (a stretch hood film provides a full enclosure and can be more material-efficient for some loads) or vice versa for cost reasons. By 2030, the food & beverage sector is expected to still dominate end-use, but it might not grow as fast percentage-wise as some other sectors simply because it’s already huge (thus TMR noting the sector might “lose some market share” as others grow

). Within F&B, frozen foods and bulk packaged foods are a growing area – they rely on stretch film for moving product from factories to distribution.

-

Industrial & Manufacturing (Incl. Construction Materials): This broad category covers products like chemicals, fertilizers, paper, textiles, auto parts, machinery, and construction/building materials – basically, industrial goods that are shipped on pallets or in unit loads. There are some notable sub-segments:

-

Construction materials: Items such as bricks, cement, ceramic tiles, lumber, insulation rolls, etc., are often secured on pallets or bundles with stretch film or stretch hood. The construction industry’s growth (especially in developing regions with infrastructure booms) directly correlates with increased demand for pallet wrap to deliver these heavy materials. Stretch film is valued here for keeping loads intact on rough trips. As emerging markets build housing and infrastructure, expect above-average growth in stretch film usage for construction supply chains. The introduction of stretch hood machines at brick or tile factories is increasing, as the stretch hood film (a heavy-duty variant of stretch film) is very secure. That segment (stretch hood film) was noted to be the fastest-growing stretch product, albeit from a small base

.

-

Chemicals and Fertilizers: Many resins, additives, and fertilizers are bagged and then pallet-wrapped. As global agriculture needs more fertilizer and as chemical production grows in Asia, this drives stretch wrap demand. Fertilizer pallets, for example, often use UV-resistant stretch film if stored outdoors.

-

Paper and Textile: Large paper rolls or batches of fabric are often wrapped for dust protection, but stretch film is used to a limited extent here (other wraps or strapping may be used for giant paper reels). Still, any rise in these manufacturing outputs can have a minor impact on stretch film usage.

-

Metals and Machinery: While heavy metal parts might use steel strapping, smaller parts and machinery components are often put in crates and then stretch-wrapped. If manufacturing output rises (for instance, automotive parts, electronics appliances), stretch film use in securing these on pallets does too. A particular trend is export of industrial goods from Asia – these pallets get stretch-wrapped for the journey to ports and beyond.

Overall, industrial/manufacturing uses of stretch film tend to track economic growth. When GDP and factory output rise, more goods need shipping protection. The expectation of continued industrial growth in Asia and recovery in other regions post-pandemic suggests steady demand from this segment. It’s worth noting that the construction segment was anticipated to be a top end-use by some analysts, grabbing 20%+ share, as construction activities worldwide remain robust

.

-

-

Consumer Products (Non-Food FMCG): This includes things like household goods, personal care products, electronics, toys, apparel – basically any consumer goods that are not food/beverage. Many of these are shipped from manufacturing sites (often in Asia) to global markets. They usually travel on pallets wrapped in stretch film for container loading, then again perhaps on pallets for distribution to stores. One trend is the increasing production of consumer products in Asia for export – meaning longer logistics chains that rely on secure packaging. Also, the electronics sector (phones, appliances, etc.) has a need for anti-static and careful packaging; high-value electronics often get additional protective packaging but still use stretch wrap at the pallet level. Retail trends like just-in-time inventory and frequent restocking mean smaller, more frequent shipments to stores, which can increase total wrapping events. However, with more direct shipping and e-commerce, sometimes goods bypass some palletization steps (going direct to consumer). It’s a mixed impact, but overall FMCG growth in emerging markets (where more people buying appliances, personal care products, etc.) increases local packaging needs.

-

Pharmaceuticals and Medical Supplies: The pharma industry uses stretch film to wrap bulk shipments of medicines, vaccines, medical devices, etc. This became highly visible during the COVID-19 vaccine distribution – pallets of vaccine cartons were stretch-wrapped to maintain security and temperature (with cold packs). Pharma requires clean, strong, and often tamper-evident packaging; stretch film helps by showing if a pallet was disturbed. As the pharmaceutical sector grows (especially biologics which need cold chain), stretch film demand grows correspondingly. Some pharma distributors use colored or opaque stretch films for confidentiality or light protection. The medical sector also ships a lot of disposables and equipment which are palletized. Overall, while this isn’t the largest segment, it is stable and was estimated around mid-single-digit share of stretch film usage in some breakdowns

. The trend of aging populations and increased healthcare globally means more pharma logistics – a positive signal for stretch film.

-